Exploration of Netizen Perspectives on the Implementation of the Core Tax Administration System

(A Netnographic Study)

DOI:

https://doi.org/10.37012/ileka.v6i1.2634Abstract

The Directorate General of Taxes continues to carry out intensification and extensification in optimizing tax revenues. One of the intensification efforts applied by the Directorate General of Taxes in increasing tax revenues is through the implementation of the core tax administration system (CTAS) in optimizing the taxation system. In the current era of technological development, it has become a way for modern society to express opinions and convey their opinions on public policy issues, such as the coretax issue which has become a hot topic and even a trending topic in Indonesia. This study aims to identify and analyze netizen perceptions regarding the implementation of the core tax administration system in Indonesia. This study uses a qualitative approach with the netnography method. Data were collected through observation, interview, and documentation techniques on various digital platforms such as TikTok, Twitter, Instagram, and Facebook, by utilizing popular hashtags such as #coretax. Data analysis was carried out systematically using a qualitative analysis approach assisted by NVivo 15 software. The results of the study show that netizen perceptions of the implementation of the core tax administration system consist of pros and cons. Some netizens welcomed the digitalization steps as part of the modernization of tax administration, but not a few expressed concerns regarding the complexity of the system, increased workload, and the psychological impact experienced by tax officials. Therefore, the Directorate General of Taxes must evaluate the implementation of the coretax system to strengthen support for digital transformation in the taxation sector.

Downloads

Published

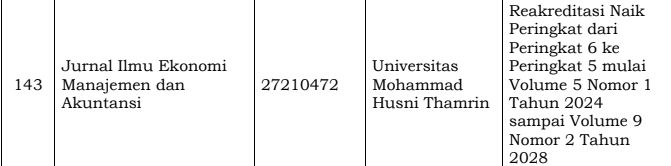

Issue

Section

Citation Check

License

Copyright (c) 2025 Aldo, Eliza Noviriani, Roshani

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.