Stock Investment with Bollinger Band Indicator, Moving Average and Relative Strength Index of Three Big Capitalization Issuers of Telecommunication Infrastructure

DOI:

https://doi.org/10.37012/ileka.v6i1.2587Abstract

The purpose of the study is to determine the buying and selling prices of three Big Cavitalization Infrastructure Telecommunication issuers in the 2020-2023 period with the Bollinger Brand, Moving Average and Relative Strength Index indicators. Quantitative research with secondary data on the research population of three Big Cavitalization Infrastructure Telecommunication issuers using the Bollinger Bands indicator to determine the Buy signal can be seen when the Candle touches the lower band, while to determine the Sell signal can be seen when the Candle touches the upper band. From the results of the study, the total signal accuracy level was obtained as many as 53 (fifty-three) signals, consisting of 20 Buy and Sell signals with an accuracy level of 100%. Consisting of 40% correct signals and 60% incorrect signals at PT Telkom Indonesia (Persero) Tbk, 15 Buy and Sell signals with 100% accuracy rate consisting of 73.3% correct signals and 26.7% incorrect signals at PT Indosat Tbk, 18 Buy and Sell signals with 100% accuracy rate consisting of 33.3% correct signals and 66.7% incorrect signals at PT XL Axiata Tbk. The results of this study obtained a total Capital Gain of 148.85% and a total Capital Loss of -116.68%, consisting of 34.07% Capital Gain and -55.89% Capital Loss at PT Telkom Indonesia (Persero) Tbk, 69.2% Capital Gain and -18.89% Capital Loss at PT Indosat Tbk, 45.58% Capital Gain and -41.9% Capital Loss at PT XL Axiata Tbk. It can be seen that using the Bollinger Bands Indicator can provide quite good results compared to using the Moving Average and Relative Strength Index indicators.

Downloads

Published

Issue

Section

Citation Check

License

Copyright (c) 2025 ependi, Putu Tirta Sari Ningsih, Muhammad Gusvarizon, Yohanes Bowo Widodo

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

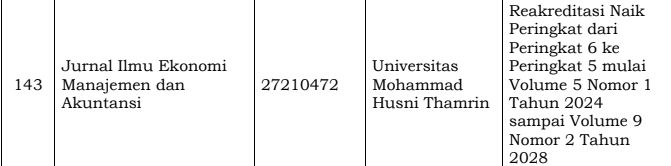

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.